This topic is becoming more and more interesting for many of us. The interest rates that are screaming at us from the ads on the internet are already so low that many of us with a mortgage pause on this topic and a simple question comes to mind – could I also have a lower interest rate thanks to refinancing and thus pay less?

In today’s article we will answer this question. So let’s say:

- When can I refinance?

- Under what conditions is it worth it?

- How does the whole process work?

When can I refinance

When we arrange a mortgage, we always choose the length of the fixing period, e.g. 5 years. This is a contractual arrangement that says for how long the interest rate and repayment will be fixed. Three months before the end of this period, the bank is then obliged to send an offer of a new interest rate for the next fixing period. And as it happens, the new offer is very often significantly higher than the conditions under which the same bank negotiates new mortgage loans.

The law is clear on this point. The loan can be fully repaid without penalty on the anniversary of the fixation. And that means another bank can do it for us. So if I don’t like the way my current bank values me, I can let another bank take over the imaginary baton of my mortgage loan.

Despite the myths I sometimes hear, I don’t lose anything by refinancing, and on the contrary, I take this step to save money in the form of a lower amount of interest paid.

Since March 2019, we’ve also seen a rise in the ability to refinance outside of fixing. Yes, it’s possible. Most banks charge a penalty of around CZK 1,000 for this breach of the loan agreement. However, it should be mentioned that this window is likely to close very soon.

Under what conditions will refinancing pay off for me

The answer to this question is quite simple. Refinancing pays off for me when the savings outweigh the costs. The costs that are associated with refinancing are always fees to the Land Registry. We will pay one fee for the entry of a new lien and one for the deletion of the previous one. So twice 2 000 CZK. In addition, we may be subject to appraisal or processing fees, but this is very rare as banks have waived these fees in most cases.

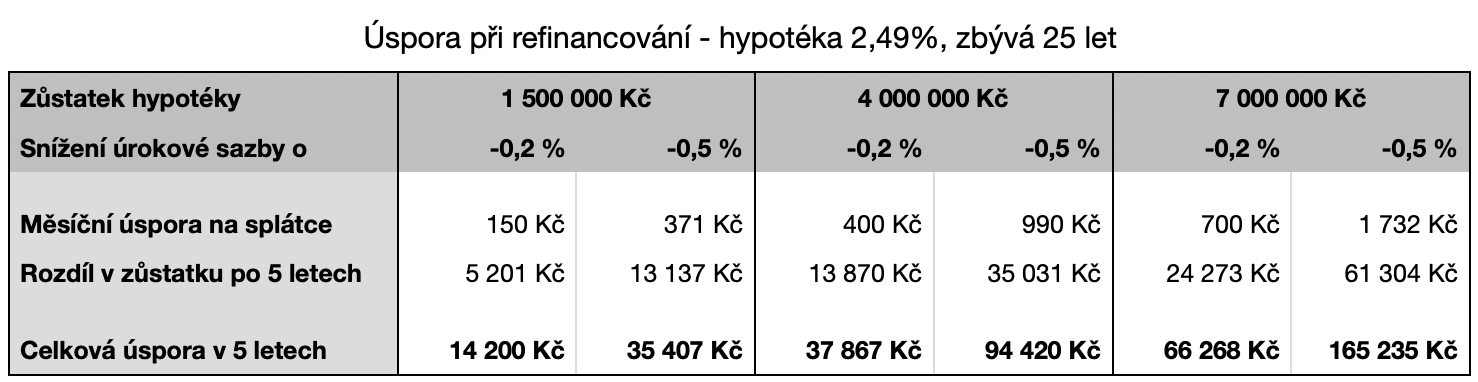

So let’s do the math. Let’s say the current mortgage was taken out for 30 years, has been running for 5 years and the current bank’s offer is 2.49% per annum for the next 5 years. In the table below we show what savings would be involved if the new offer is 0.2% or 0.5% better at different balances. We calculate the saving on the repayment over the next 5 years and add the difference in the balance at the end of the 5 year fixation.

As we can see, even a small reduction in the interest rate on a high mortgage (and vice versa) can mean significant savings.

Even greater savings can be achieved if we invest the money saved in the repayment wisely. But that’s a topic for another article.

How the whole process works

Very simply! You need to provide proof of income (e.g. one bank statement) and an estimate of the current value of the property. In the case of houses, a visit by the bank’s appraiser will be required, while in most cases photos and a document indicating the size of the apartment (e.g. utility bill) will be sufficient for apartments. Then you just have to prove the previous loan agreement and its valuation as of the date of refinancing, arrange the registration of the lien at the land registry, transfer the money from the bank to the bank and that’s it.

You will need to have a current account with the new bank for repayment. However, it is not necessarily a requirement to transfer all payments to that bank.

Conclusion

When refinancing, you should always simply calculate your savings and decide accordingly. If you don’t want to worry about the calculations, ask your financial advisor or maybe me. Simply pick up your phone, log into online banking, click on your mortgage information, take a screen shot and send it to me.

If refinancing makes sense, let’s discuss your options over a good cup of coffee.

Read also about is one specific example from practice:

How we saved CZK 133 996 thanks to refinancing