Today I would like to share with you some tips on interesting investment opportunities. Inflation is a very nasty money guzzler, but so are the various sellers of corporate bonds or gold. So below are a few ideas on how to make money safer today, both in the short and long term.

So let’s take it in order:

- for conservatives – 6.25% p.a.

- for housing cooperatives and JVUs – 6.30% for 2 years

- short money for 3 years and more

- he who waits, will wait

For conservatives – 6.25% p.a.

The current high interest rates on savings accounts do not result from the pro-client approach of domestic banks, but from the level of the so-called 2T REPO rate. This rate is set by the CNB and is currently at 7% per annum.Banks deposit money directly with the CNB at this rate. They then leave around 5% to the clients and the rest is left to their profits.

This opportunity has been seized by a number of investment companies that perform virtually the same operation, but keep a smaller margin and, for example, with Conseq Repofund it is currently possible to get 6.25% per annum.

And although the fund is not insured as a bank account up to CZK 2.5 million. CZK, but in practice it is probably the safest possible operation on the money market, since the collateral against the investment is securities issued by the CNB, which I consider to be an even safer solution than the deposit insurance fund. Compared to a savings account, the return is not subject to withholding tax each month, so the uncollected tax is compounded.

The tax on the proceeds is only payable on redemption and can be avoided altogether if the withdrawal is less than CZK 100k. CZK per calendar year or the money would be in the fund for a total of more than 3 years. The funds can be withdrawn to your account in about a week.

For housing cooperatives and JVUs – 6.30% for 2 years

Unit Owners’ Associations (HOAs), Housing Cooperatives (HCs) and other similar entities often have hundreds of thousands to millions of crowns in their current accounts. This money is usually earmarked for future repairs or renovations, and so often waits several years to be used.

Thanks to the currently high rates, it is possible to take advantage of the offer of time deposits. For example, J&T Banka currently offers 6.30% p.a. on an annual or 2-year term deposit, or 5.50% p.a. for 5 years.

The money is locked up, but with a guaranteed return and an insured deposit, which conservative committee members appreciate. For example, 1 mil. CZK on a 2-year fixed deposit earns CZK 107,100 after tax. So ask your HOA/BD president how much money you have in the fund, how they are working for you, and whether this investment opportunity could bring you additional income for the repair fund.

Investment opportunity for “short” money for 3 years and longer

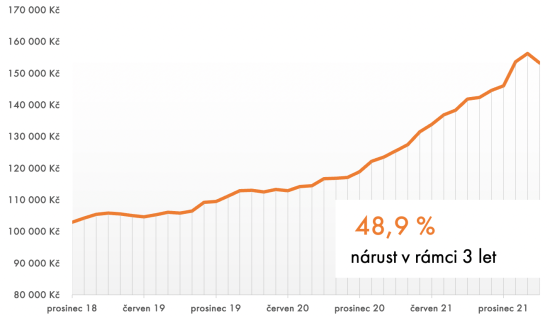

If we are aiming for interesting appreciation, with access to money and a horizon of at least 3 years, then real estate funds are an interesting long-term solution. They buy properties which they then rent out and the income comes from the rent and the growth in the value of the properties in the portfolio. However, I would be a bit more cautious these days about funds buying corporate real estate, such as offices or shopping centres.

One of my favourites is the Future X1 fund, which buys exclusively new-build flats in Prague. Although real estate has been declining in value overall since the beginning of this year, new buildings are holding their value and their potential is rather upward in the coming years. The fund is targeting a net return to the client of 5-6% p.a. However, in the coming year, the fund is expecting a very profitable acquisition of 16 residential units in the Arcus City project, which will bring exceptional returns to the fund. The valuation next year will thus probably be in the range of 8-9% p.a.

He who waits, will wait

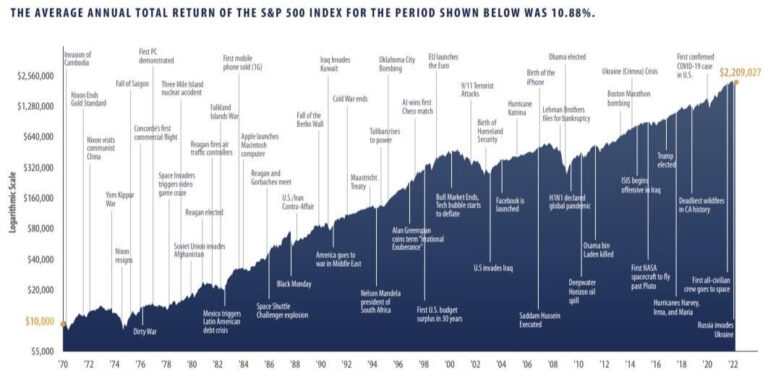

The absolute biggest investment opportunity is currently investing in stocks or bonds. So we are talking here about investing in broadly diversified equity and bond funds. These have taken a beating in the last year and are trading tens of percent below 2021 prices. The general public is not very keen on buying shares, but this is exactly the ideal time to start.

Buying at the top and selling at the bottom is unfortunately what most inexperienced investors do. Yet the opposite is exactly what we all want. The markets are bottoming out now, so it is an ideal time to start investing in them, and to do so diversified, with a horizon of 10 years or more, ideally dissolving the initial investment into more smaller ones over time and adding to it periodically thereafter. For example, the deferred 1 mill. CZK for 10 years or more I would invest in 5 payments of 200 thousand CZK each. CZK per month and then set up a standing order for an amount I can comfortably afford.

The cyclicality of the economy and compound interest will take care of the rest.

Equity markets have historically appreciated 10% p.a. over long horizons, which is beautifully illustrated by the infographic below describing the returns of the 500 largest publicly traded companies in the US over the last 50 years.

Conclusion

Ačhow many are currentlyě on the jointřof the current accountsčtech interesting valuations, so long-termě neverřthey outperform inflation. They’re so good only for dr.žthe moment of

ž

the reserves. The remaining spaceředges will mature in the long termě above inflation only if they are correctlyě invested.

The basis of the přand creationsě investmentsčportfolio is inžalways determining the horizonů his individualých čtion, adequate risk assessment and diversification at the investment levelčof instrumentsůbut also třměof the region čand froměof the region.

If you něasý of the aboveýwhich instrumentů interested or want to make an investment

č

her customized portfolio, let’s put online čand offline coffee