Probably no one who has been interested in the possibility of taking out a mortgage in recent months could have missed the various alarmist reports about rising mortgage interest rates.

However, the average interest rate on mortgages in the first quarter of 2021 was still below 2% p.a. However, this is mainly due to the fact that the signed loans were arranged earlier and therefore at a time of lower rates.

At the moment we are practically out of rates starting with one. New mortgages start at 2.XX% and banks continue to plan to increase.

What it means in real numbers

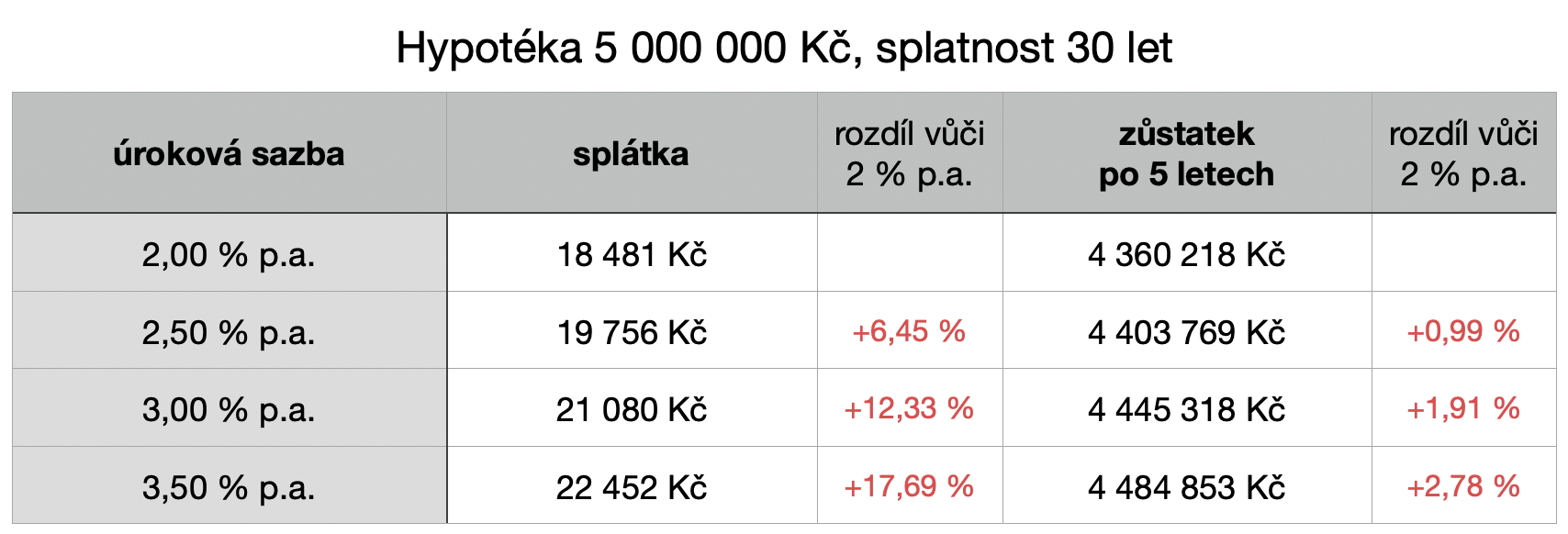

So let’s see what a higher interest rate will do to your repayment and how it will affect your loan balance over the years. An example would be a mortgage for 5 mil. CZK and a maturity of 30 years.

The table shows that the interest rate primarily affects the amount of the repayment and only minimally affects the balance.

What happens after fixation

If you have already arranged your cheap mortgage, then you are assured of the amount of your repayment for the duration of the fixation period. What happens next? The bank sends a letter 3 months before the end of the fixation period with an offer for a new fixation period. At this point, it should be noted that it is almost always possible to reduce this offer, either by proper negotiation with the current bank or by switching to another bank. In either case, it is advisable to contact a financial advisor who will have some negotiating leverage.

However, if you have a mortgage at 2% and at the end of the 5-year fixation the market rates will be around 3%, then we will not be able to avoid the increase. Below we show what such an increase in the interest rate after fixing can mean in real terms. I consider it important in this case to take into account a healthy inflation rate (2% per year), i.e. to express any increase in “today’s money“.

The possibility of increasing the repayment after fixation should be taken into account and not take out a mortgage with a repayment at the edge of your financial possibilities. On the other hand, even in a very pessimistic scenario, we are talking about an increase of a tenth in real money, which is not so scary if we consider that wages have risen by 26% in total over the last 5 years. If you are still afraid of the possibility of an increase, choose a longer fixation (e.g. 8-10 years), which is slightly more expensive but represents the desired security.

What awaits us

The current increase in interest rates was mainly triggered by the rise in the price of money on the interbank market. The basic 2T REPO rate has not changed since May 2020 and the CNB continues to keep it at 0.25%. Banks are currently reporting an extreme glut and are not able to approve new business in a reasonable time, which may also be driving up prices for some.

At the last CNB meeting in April 2021, Governor Jiří Rusnok commented on this issue by saying that he did not think the 2T REPO rate should be adjusted before August 2021, when they have a new economic forecast. And even at that time, they may just be planning for an increase.

However, one or two increases of 0.25% could be expected before the end of the year.

The reality is that interest rates of around 3% p.a. can be expected at the end of 2021 .

The issue of tightening mortgage lending rules is also very likely to be on the table soon. DSTI max. 45 % and DTI max. 9, which the CNB very quickly cancelled after the outbreak of the first wave of covidence, can be reinstated very quickly.

Conclusion

The main purpose of this article is to give you an idea of how much a mortgage costs today, how much it may cost tomorrow and what will realistically make it more expensive over time.

When we take out a loan that we will be repaying for the next 30 years, it is very important to pause for a moment in the intoxication of the idea of a new home and calculate with a cool head whether we can afford it and whether we are prepared for darker scenarios. Just use common sense.

I will be happy to help you with the calculations over coffee, either in person or remotely.