We are only a few weeks away from Christmas. This year it went by even faster than ever.

Today, let’s take a look back at how the mortgage market has evolved in these crazy times and also look at how I see mortgages continuing to evolve.

Let’s take a closer look at:

- Numbers to date

- Impact of the second wave of COVID

- Interest rates in in the following months

- Wait? For what?

Numbers to date

Would you say that in a year affected by a pandemic, a closing economy and the highest state budget deficit the Czech Republic has ever had, people will be more cautious in light of an uncertain future and the real estate market will stop or at least slow down? The exact opposite is true. Banks are reporting records. Let’s look at the actual numbers:

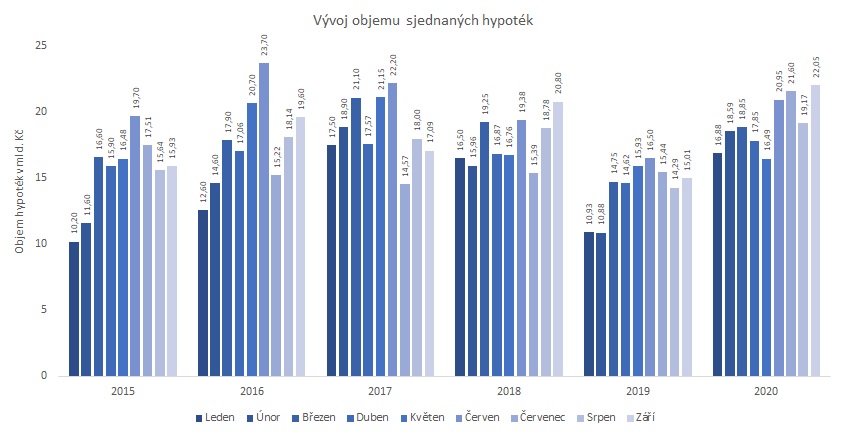

In the first 9 months of this year, a total of 64,150 mortgage loans were closed, with a total volume of CZK 172 billion. Approximately one-fifth then with purpose refinancing . So far, 2020 is surpassing even the record numbers from 2016 and 2017.

The increase in the volume of mortgages taken out is undoubtedly due to the constant rise in property prices. The average amount of one mortgage loan arranged increased by approximately CZK 500 thousand year-on-year.

Impact of the second wave of COVID

The second wave of the pandemic crisis is having a similar response to the first. Here again, mortgage lending to subprime applicants is being restricted or suspended.

These include:

- Tourism

- Cultural and entertainment activities

- Catering and hospitality

- Freight transport

- and others with regard to current measures

The second relatively unexpected impact is a slight increase in interest rates at some banks. But this is happening for a different reason than we would expect.

As we said above, this year is a record year in terms of the number and volume of mortgage loans. However, there were no new additions to the processing and approval teams of the individual banks. On the other hand, a lot of them are in the ICU. So the existing workforce is getting more than usually loaded. The situation is not helped by working in a home office.

Banks, which have picked up a large number of new loan applications by lowering their interest rates, are now proceeding to increase them back. They simply know that they have no chance of handling that number in a reasonable amount of time.

It is becoming increasingly common that the mortgage applicant chooses a bank not only on the basis of the best offer, but also on the basis of the current workload of the bank and its ability to approve the loan by the deadline of the reservation contract for the property to be purchased.

Interest rates in the coming months

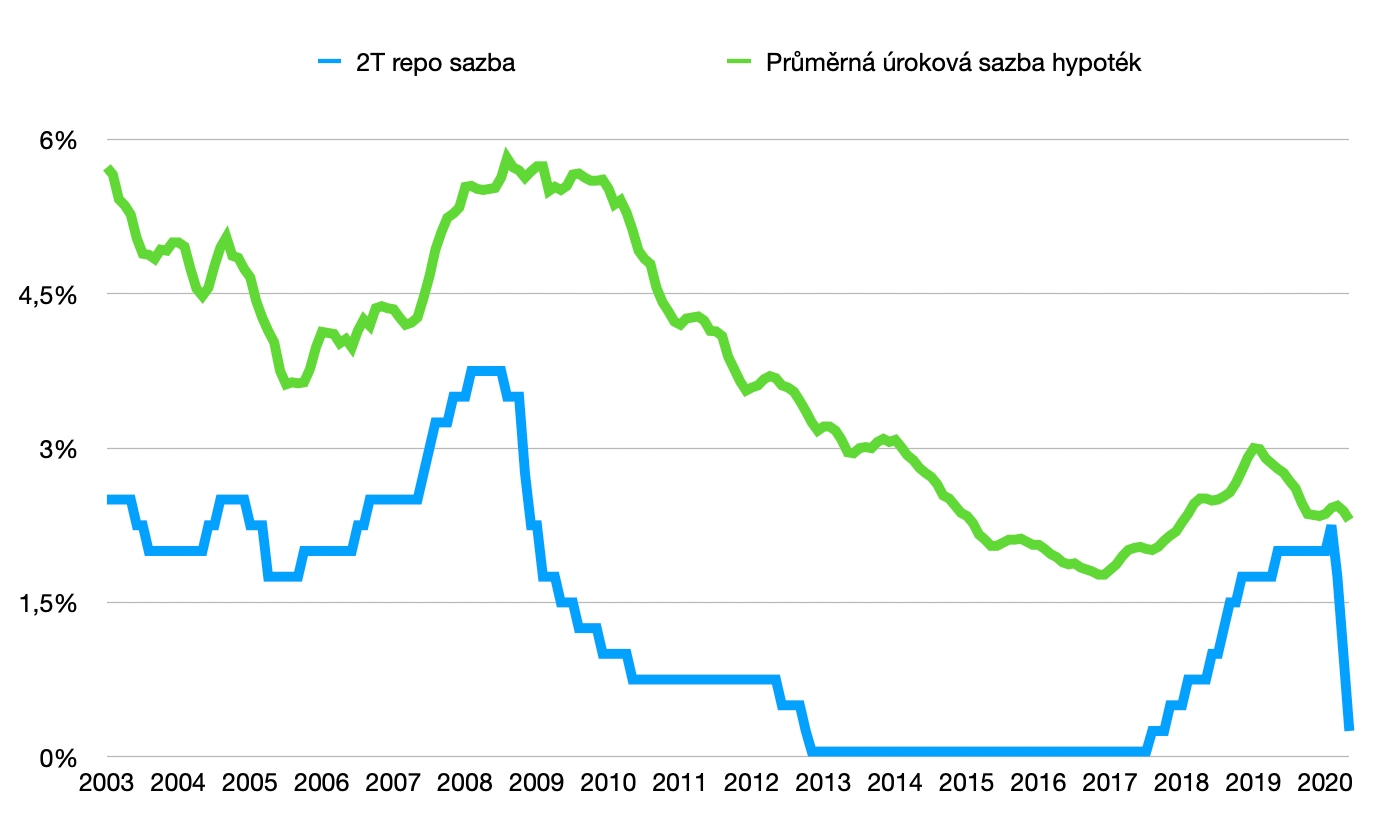

Already in the first wave of the COVID-19 pandemic, the CNB practically fired all its ammunition to encourage the banking market to cut rates. It lowered the base rate to a symbolic 0.25% and removed its previous recommendations on DTI, DSTI and raised the LTV threshold. There is thus no reason to assume that the CNB would make any significant cuts, given that our monetary policy does not envisage a negative 2T repo rate.

Where we can find room for reduction, however, is certainly in the margins of domestic banks.

As we can see from the chart, last year banks were able to trade mortgage loans at a significantly lower margin than this year. The reason why the scissors have opened again is of course the situation around COVID. Compared to last year, there is a chance that a greater number of people will be unable to pay their mortgage, precisely because of the government’s measures and the overall impact of COVID. Banks simply have to reflect the higher risk in the interest rate. Deferring repayments has also had a negative impact on their cash flow. If we expect the situation to calm down more in 2021, we can expect more competition between banks and thus a slight decline in interest rates. However, we should expect a rather symbolic fall of a few tenths of a per cent.

Wait? For what?

Who can think of 2 things with regard to the current situation:

- I’ll wait for the crisis to peak, property prices to fall and buy cheaper.

- I’ll wait for an even cheaper mortgage.

We’ve already said our piece on the first previously . Indeed, it would take a near catastrophe for the demand for real estate in the Czech Republic to fall below the low supply level , leading to a decline in residential property prices.

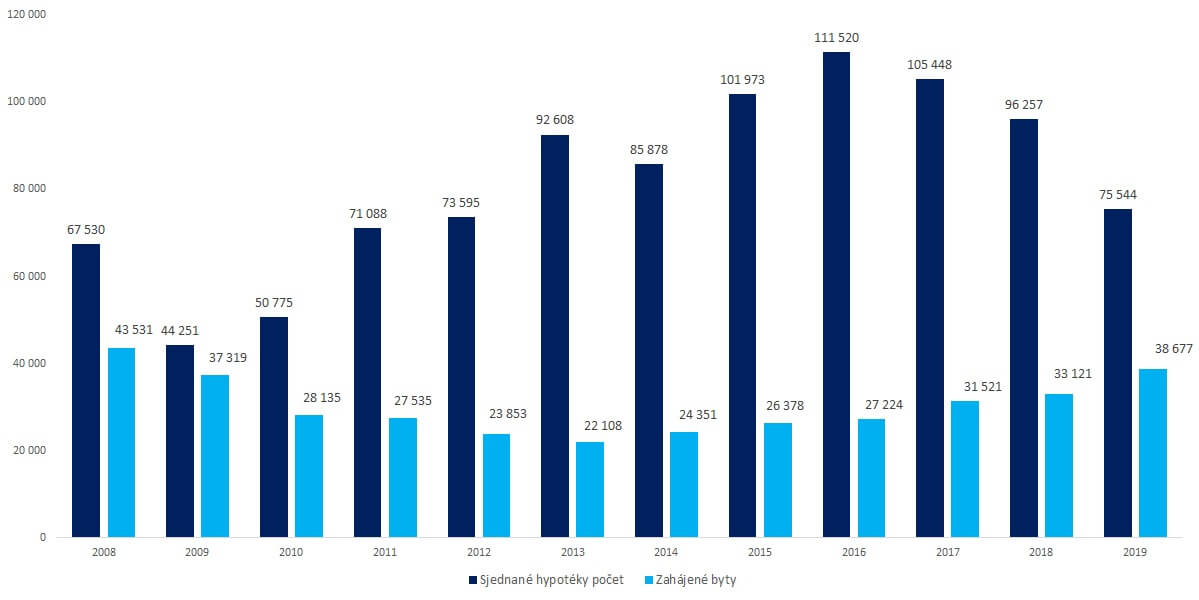

Let us show below a simple reason for this statement, using the example of a comparison of the number of mortgage loans taken out and new housing starts .

Consider that one in five mortgages refinance another. Even so, from 2015 onwards, on average 2.5 mortgages will be taken out for every new apartment. Yes, flats are sold on the secondary market, but their original owners have to live somewhere else.

The abnormal interest in owning one’s own home is thus a driving force for further growth in property prices.

On the second point, “I’ll wait for a cheaper mortgage.“What good is a few tenths cheaper mortgage if I pay hundreds of thousands more for the property?

Conclusion

2020 has certainly shown us that anything can happen. However, we cannot predict what the future will bring based on our wishes, but should be guided by available data and common sense.

Do you have any questions on this topic? Email it to me and I’ll be happy to discuss the topic with you.