Today’s COVID era has undoubtedly turned many an investor’s head. The capital markets suffered a deep blow in the first half of the year that some sectors will take years to recover from. On the contrary, other sectors and some commodities are benefiting from the current situation. However, the question is not what has happened, but what we are interested in is how our investments will continue to develop. Where should I invest to get the highest appreciation?

I will tell you right at the beginning of today’s article that I don’t have a clear answer to this question, and I won’t even try to give the impression that I have any background information or even a crystal ball.

But what we will definitely cover are some basic ways to value our assets, how to look at them and, as a result, gain some perspective and not be tempted into making ill-advised emotional decisions.

If you want to start with a little more layman’s take, listen to one of my Podcasts :

In this article we will discuss:

- Gold, silver

- Bitcoin

- Corporate bonds

- Real Estate

- Real estate funds

- Shares (last but not least)

So let’s get down to it and show you step by step the possibilities of where to invest.

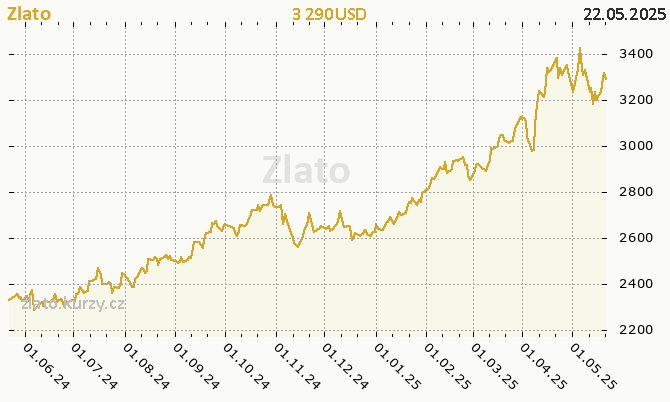

Gold, silver

Gold and silver dealers wash their hands these days. And rightly so. Year-to-date in 2020, the price of gold per troy ounce is up 24%, and silver is up 34%. The question remains whether precious metals are already at their peak or whether their price will continue to move in the same direction.

Gold or silver definitely has its place in our investment portfolio. However, it is necessary not to overdo it. Keeping 10-20% of your assets in them is definitely healthy. A higher ratio is then out of the question.

If you are going to buy precious metals, I recommend the following:

- buy ingots 1 oz to 100g

- do not invest in gold by saving

- don’t speculate on price increases unless you are an expert

- inquire about the price from multiple suppliers

- consider the difference between buying and buying(spread)

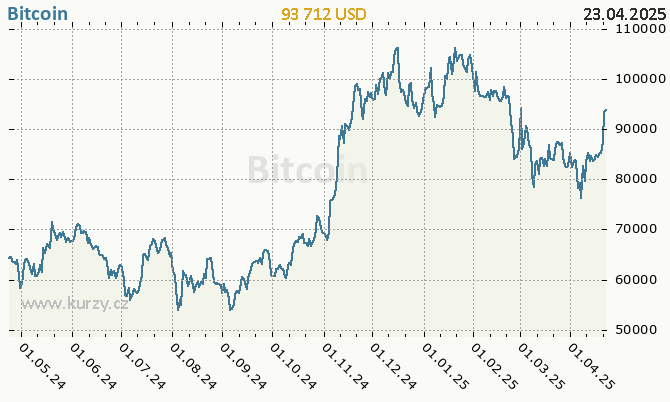

Bitcoin (BTC)

Corporate bonds

The corporate bond market in the Czech Republic has grown to, I would say, unhealthy proportions in recent years. The principle of a corporate bond is that company XYZ borrows money from its creditors(investors) in the form of a bond. The prospectus of the bond specifies the maturity of the debt (usually in years) and the coupon (appreciation in %), which will be paid at regular intervals (e.g. after 1 year).

There is no problem in the principle itself. Under clear conditions, I know in advance when the money will be returned to me and what interest I will collect during that time. The problem itself is what companies often issue bonds and how they are sold. The risk associated with corporate bonds is found in the issuer itself (firm XYZ). If the company in question is unable to meet its obligations and goes bankrupt, it is also possible that the bond itself becomes a worthless piece of paper. This is evidenced by the recent case of an unnamed Czech-Slovak financial group. Some vigilance is therefore needed in this respect. On the other hand, there are bond issues that are definitely worth considering.

So what to watch out for:

- Does the offer sound too tempting? (in the order of >10% p.a.)

- How many issues has the company issued in a row? Isn’t he driving a wedge through the wedge?

- How much equity is the company investing in the project?

- What is the company’s equity according to publicly available financial statements?

- Is the issue approved by the CNB? It is not entirely necessary, but thanks to the approved CNB prospectus we will get more information for decision-making.

Real Estate

Buying real estate could definitely be described as one of the most interesting conservative investments. There is still a high demand for them in the Czech Republic, and given how little is being built, it is expected that demand will continue to exceed supply in the coming years. This is also supported by low mortgage interest rates, which are not expected to rise and we rather assume that cheap mortgages will be around for some time.

If we consider the net annual return on a purchased apartment, we do not arrive at a staggeringly interesting value. However, it is true that most investors think about buying in a slightly different way. I buy with a mortgage, the tenant pays it off and the property remains debt-free for my children or as passive income in old age.

However, it should be added that the actual purchase of investment property on debt needs to be well calculated. Firstly, in order to get the best mortgage interest rate, we need 20% of the purchase price in cash, and we also need to allow for a certain reserve in case the tenant does not pay the rent, the apartment is empty or the property requires renovation over time.

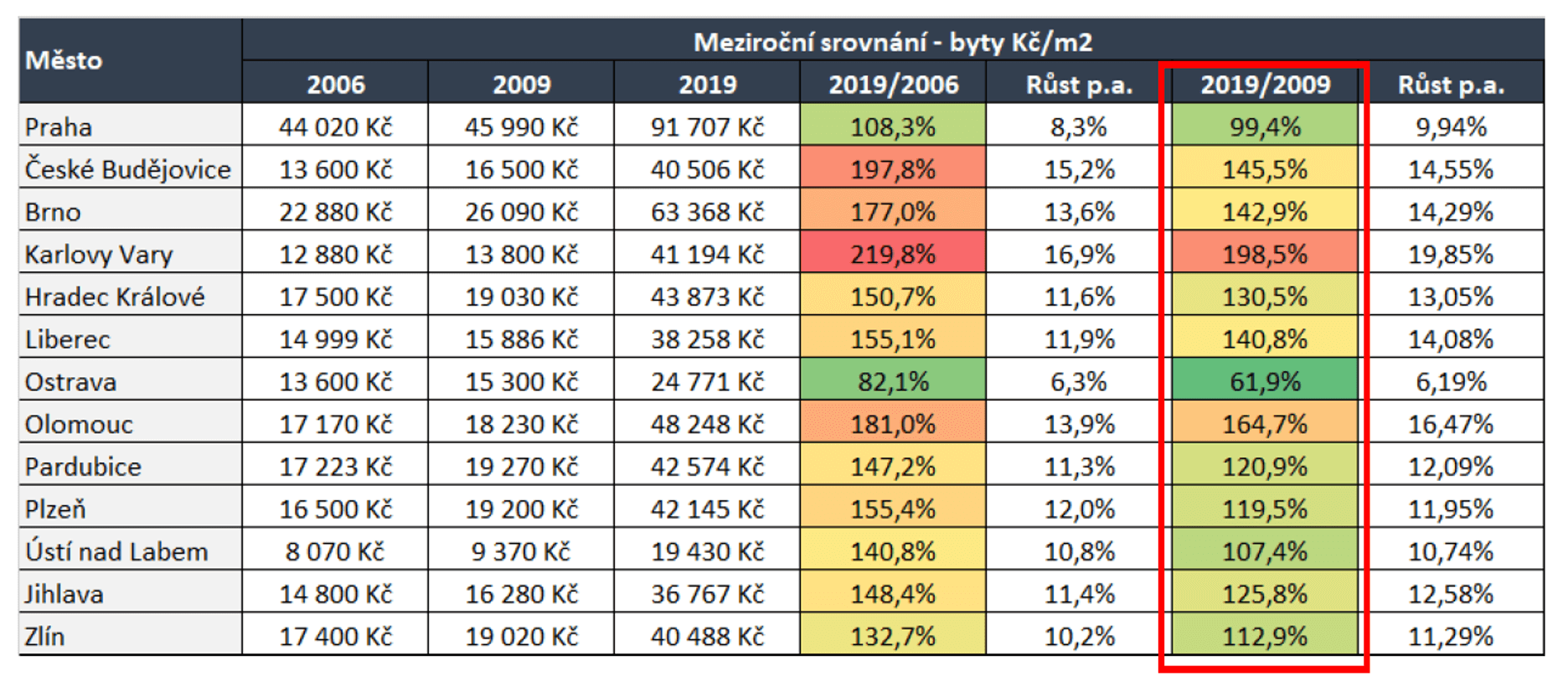

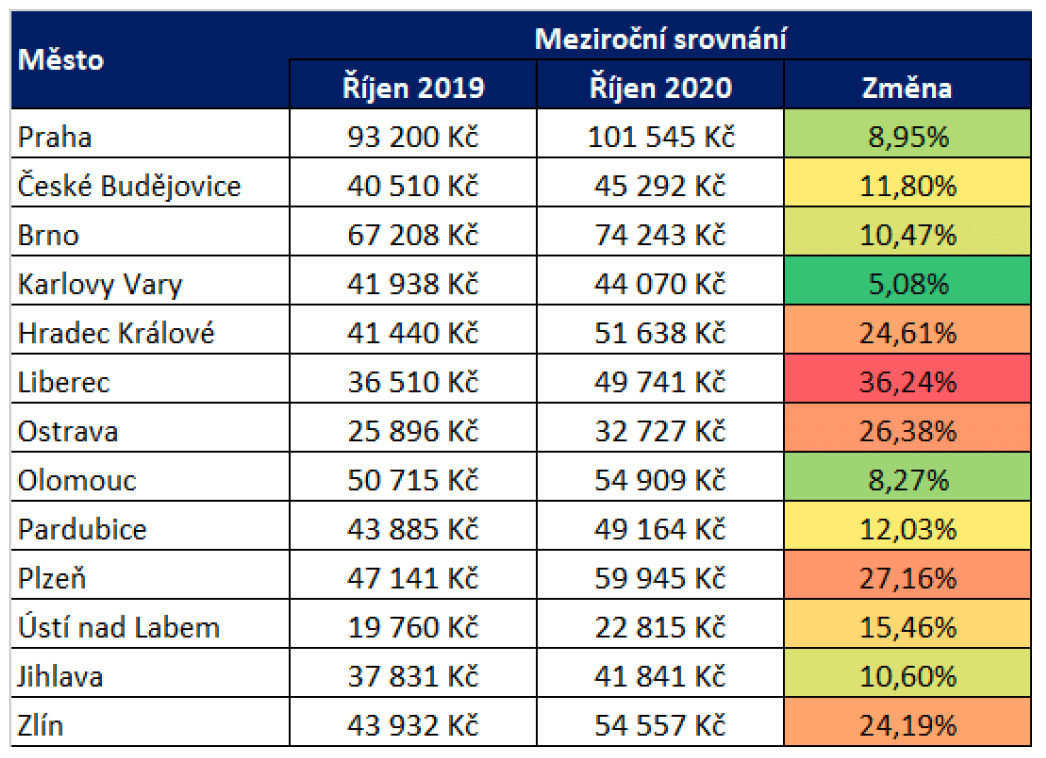

Let’s take a look at the year-on-year comparison of apartment prices on the secondary market:

As can be seen, the excess of demand over supply will set the pace of price growth in 2020. When deciding where to invest, residential real estate is definitely worth considering.

Real estate funds (real estate)

One of the would-be conservative investments, which has also been torn apart in recent years, is certainly investment in real estate/real estate funds. I myself have been happy to recommend this investment to my clients for inclusion in their portfolios. My advice now is to buy while we’re up. Why, we will tell you below.

Real estate funds buy mainly commercial premises – shopping centres, offices, etc. The yield itself consists of two parts. The rental yield of these properties and the growth in their value. And now you probably know the reason why I advise clients to get out of this position. The COVID era has taken a toll on commercial real estate. The year 2021 is likely to be very negative for the value of the units of these funds. Real estate funds in the Czech Republic, practically without exception , buy real estate properties into their assets at an expensive price and then revalue them upwards according to various accounting methodologies. The book value of these properties thus very often significantly exceeds their fair market value. And Czech real estate funds do not sell their properties to confirm the truthfulness of their book values.

If more money flows into the fund than flows out, there is no big surprise for the investor. Unfortunately, footfall in shopping centres has dropped significantly, which will result in lease terminations. A similar future awaits other commercial properties. Thus, 2021 will very likely mean a legal obligation to revalue real estate funds’ assets, and this may result in a decline of tens of percent.

Shares

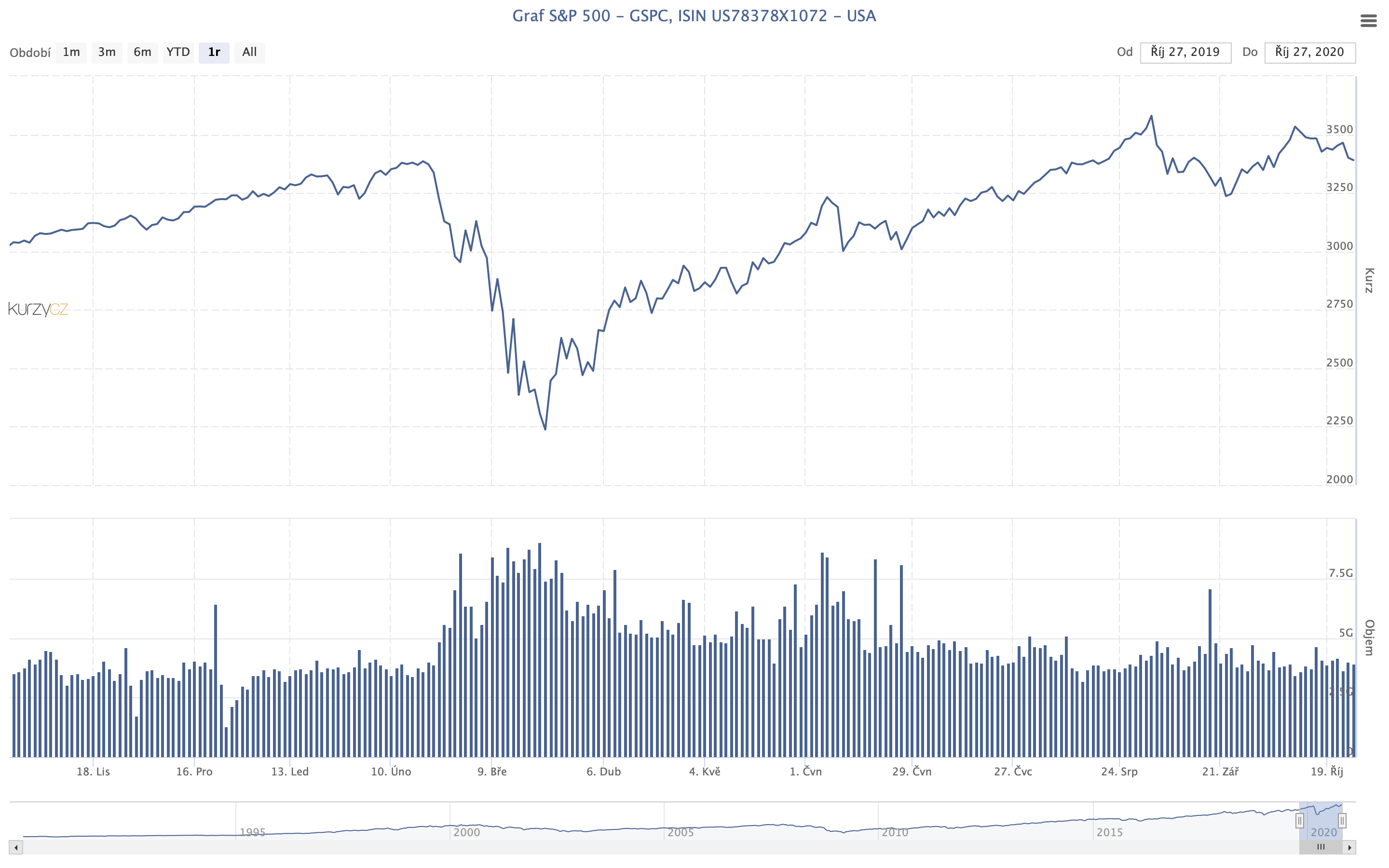

I kept the stock, quite deliberately, last in line. Their analysis is very difficult nowadays. Let’s look at the S&P 500 index.

The Standard & Poor’s 500 is a stock index containing shares of the 500 largest publicly traded companies in the US. In the first wave of COVID, this stock index experienced a 34% decline. It took approximately 100 days and its value was back to the original numbers. What has fundamentally changed, however, is the structure of its capitalisation. While the industrial, financial, services, energy sectors are still significantly affected by the crisis and will take some time to recover, the technology and online communication sectors have shot up.

However, the growth of these sectors is so enormous that it defies any rules of sound investing based on fundamentals. For example, if you were to invest according to this most famous stock index, you would pay on average more than 30 times its annual earnings per share (p/e >30). In the case of some titles, we can even get to significantly higher numbers.

Another interesting indicator to watch is the “price to book ratio” or P/B. This tells us what the ratio of the share price to the company’s equity is. For example, Apple trades at P/B = 27. This means that if I theoretically buy the whole company, i.e. 100% of the shares, I will buy it for 27 times its book value. Does that sound like nonsense to you? Who in their right mind would make such a deal, right?

In contrast, we have a perfectly healthy company such as Česká zbrojovka, whose recent IPO (first entry on the stock market) was rather disappointing. Why? I guess she’s not sexy enough.

As you can see, the stock market is far from common sense, and closer to pure speculation. I have nothing against speculation. After all, it is speculation that in many cases brings capital into companies for their further development. However, if you invest in stocks, at least consider the geopolitical influences that drive the stock market. I would definitely wait to buy some titles until the situation after the US presidential election becomes clearer.

Conclusion

I come across as a bit of a pessimist in some paragraphs. I assure you that it is not. If you are a bit confused by this article, remember the 3 basic rules:

- It is better to invest the free money than to keep it in a current account and let inflation eat it up.

- Diversification, diversification, diversification! Let’s just not carry all the eggs in just a basket.

- Invest wisely and without much emotion. Don’t let anyone promise you that out of 100k. will be a million in a year.