On the first of July, we all took off our masks and it seems that our lives are slowly returning to normal after the coronavirus crisis.

How this will affect the mortgage and real estate market in the coming months , we will discuss in today’s article.

So let’s go through all the changes that have taken place over the last few months and how they will manifest themselves in the coming period.

More affordable mortgages for all

The CNB (Czech National Bank) recently abolished the DTI and DSTI parameters and moved the recommended LTV limit to 90%. We have already discussed what these parameters mean in an earlier Article

In short, the CNB has transferred the responsibility of examining income back to the banks. And just as banks have relaxed the limits on 90% mortgages, that is, mortgages where you only need 10% cash to buy your home.

It even allowed banks to take out 100% mortgages in very small numbers (1 in every 20 mortgages).

However, the reality is that, with a few exceptions, banks strictly adhere to the original recommendations. In this respect, the development of mortgages is considerably stunted.

However, if the economic situation develops favourably, we can expect mortgages to become significantly more affordable again.

Reduction of interest rates

It is no secret that the CNB has also cut the 2T repo rate 3 times since March 2020. For our purposes, let’s call it the “baserate”. Its current value is 0.25%, the lowest level in the last 3 years and very close to the 0.05% level from 2012 to 2017.

The base rate can be loosely translated as the approximate rate at which banks buy. To this must be added the bank’s costs, the risk premium and, of course, the margin or profit of the bank as such.

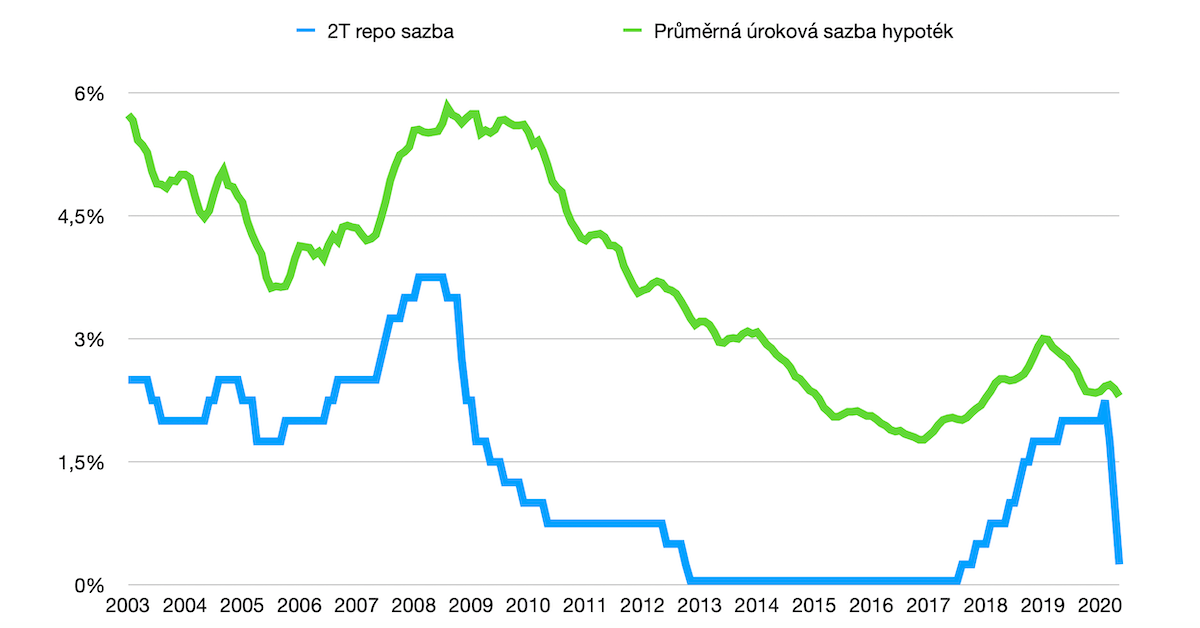

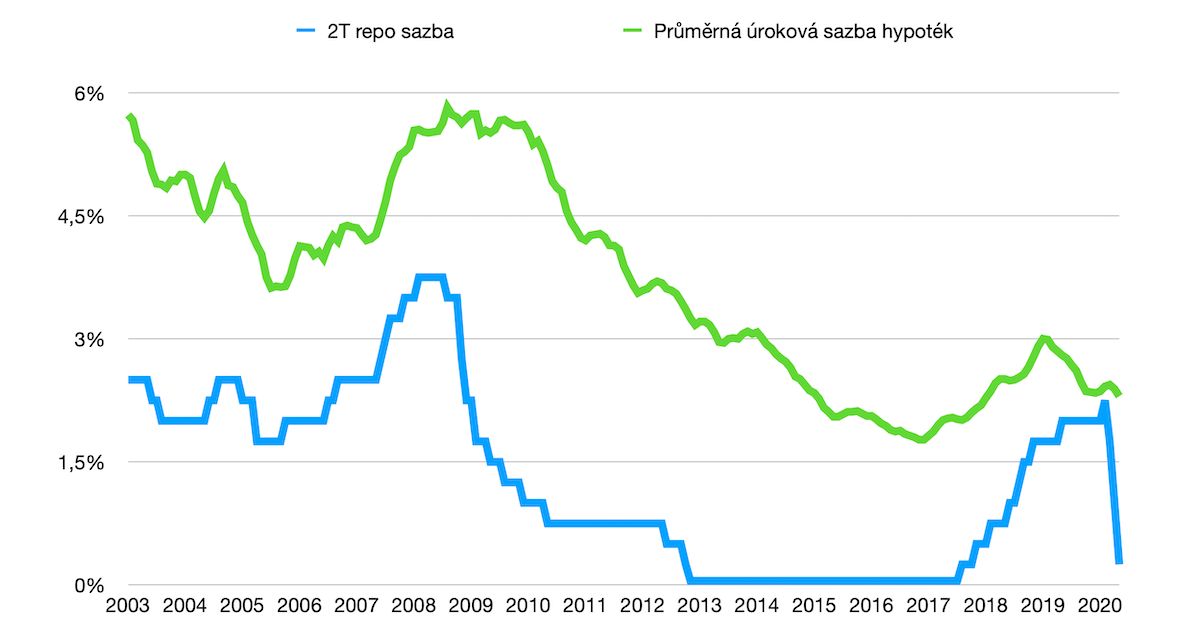

Below you can see how this base rate has evolved from 2003 to today, along with the average mortgage rate. Note the evolution of mortgages at the end.

We can therefore logically conclude from the chart that mortgages could be arranged at 1.5% p.a. in the coming months.

However, everything will depend on which of the following scenarios occurs.

Post-coronavirus economic development

Scenario 1: Negative

This scenario foresees the arrival of a “second wave“. This would lead to a renewed shutdown of the advanced economies, a severe decline in corporate sales and a sharp rise in unemployment.

In this less likely scenario, we would have to prepare for a deep economic crisis, probably lasting several years.

Scenario 2: Neutral

Most likely scenario. The pandemic will be brought under control. There will be an economic recovery. However, it will take a few more years to return to pre-COVID levels. Unemployment will rise slightly. The CNB will continue to support the economy with low interest rates.

So you will need to tighten your belts slightly and loosen them again very slowly.

Scenario 3: Positive

We can get the virus completely under control. We might even find a vaccine. In the course of 2021, the advanced economies will fully recover. Share and other asset prices will rise.

I think we would all like this scenario. But let’s think of it more as a dream that is unlikely to come true.

We’ll probably find out how that will play out this fall, when the government’s Antivirus program, which helps companies with wage replacements, ends. Then we’ll see where companies stand and whether or not they will be forced to lay off workers.

What will happen to property prices

If we could identify one segment that has hardly been touched by the coronavirus, it is the real estate market. The growth in prices of flats and houses has slowed down, but has certainly not stopped. We are still seeing high demand and low supply. As long as these scissors remain so open, we cannot expect anything other than further price increases. Only Scenario No. 1. On the other hand, an increase in supply is not in sight, as it still takes an average of 8 years to permit the construction of new residential buildings in the Czech Republic.

Waiting to buy a home when property prices fall is a fool’s dream, followed by a rude awakening.

Real Estate Acquisition Tax

Currently, the House of Commons has supported a proposal to abolish the retroactive property tax. Therefore, if the proposal passes the Senate and is eventually signed by the President, it will retroactively apply to all those who have bought property since December 2019. If you have already paid the 4% tax, you will incur an overpayment of tax and can apply for a refund once the proposal is approved. If you haven’t paid the tax yet, you don’t need to take any action. The impact of the law on the deduction of interest from the tax base is still under discussion. For the time being, it looks like we will keep this option and only reduce the deduction limit from the original 300 thousand. CZK on 150 thousand. CZK.

However, if you already have a mortgage and you acquired the property before December 2019, you will certainly be able to continue to claim the deductions for interest paid, even if refinancing .

Conclusion

What to take away from all this?

First of all, think about the stability of your current income. If you feel that your employer might not be able to make payroll anytime soon, it is certainly not advisable to embark on a new home purchase, emptying your financial reserves and signing a 30-year mortgage.

But if you can feel solid ground under your feet, you currently have a great investment window.

Mortgages are cheap and apartments are unlikely to get cheaper. If, on the other hand, you wait for even lower mortgage rates, you will find that you have a cheaper mortgage but a significantly more expensive home. In this respect, I recommend to arrange a 3-year fixation and then in about 1-2 years to refinance the mortgage refinance . This way, you can take advantage of a situation where mortgages will be at a low point and you will have already bought your home at a still reasonable price.

After all, buying your own home can in some ways be seen as an investment. It is certainly not a bad idea to have a 5 to 10 year plan for its financing and to take into account all the possible negative and positive impacts during this period.

And if you’ve managed to read this far and everything still makes sense, I’d definitely love to meet you. Let’s have a chat or a call and over coffee discuss your options and maybe your next five years🙂