Life insurance is certainly a topic that everyone will encounter more than once in their lifetime. It is a very complex product that is not easy to understand. As a result, it is very often wrong. Do I even need insurance? What to insure? How much should I pay? Should I also insure my wife on parental leave? What about the kids? I will help you find the answer to these questions in the following lines.

Do I even need insurance?

If you are a self supporting adult or still supporting a family, then there is nothing to discuss. Generally speaking, if you are likely to be financially affected by long-term treatment for an injury or illness, then it is not advisable to take the risk and insure your standard of living. Similarly, you need to take out death benefit insurance to cover your family and your liabilities (loans, etc.). You don’t need a life insurance policy if you already have enough money saved to provide for you and your family for life or if you are receiving a lifetime annuity of a sufficient amount.

What to insure and how much?

Death

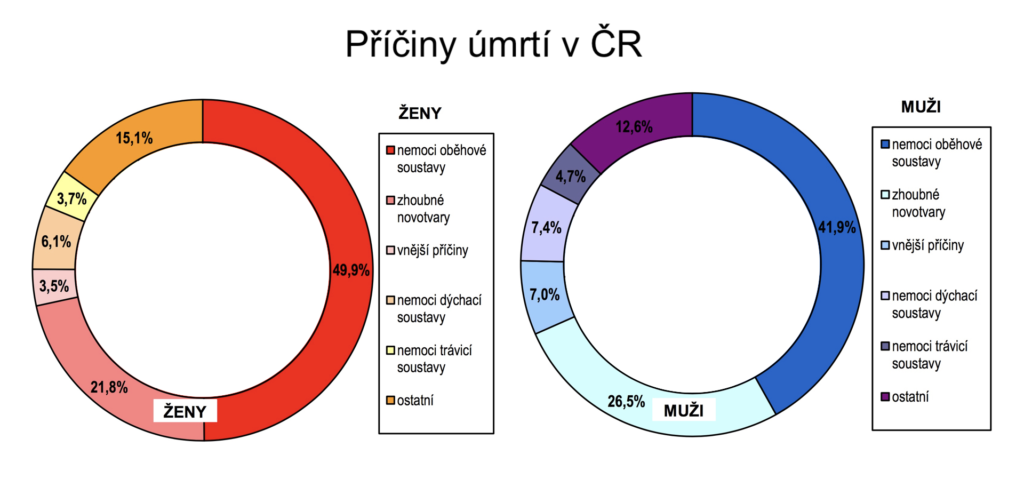

The basis of a life insurance policy is, of course, death insurance. I recommend to always choose the general variant, i.e. “death by accident and disease”. Sometimes people make the mistake of choosing the cheaper option of “accidental death insurance” or the even cheaper option of “death by car accident”. However, the numbers speak clearly. In the Czech Republic, death by injury is only 5% of the whole pie. Death in a traffic accident is even only 1%. The reason why we are more afraid of death by accident is primarily the media.

Insurance should secure your liabilities, i.e. all debts, including the mortgage. If you have a family, you should definitely think about them and set your sum assured at 1-3 times your annual income.

Example:

I am a car mechanic, I earn 25 000,-CZK/month, I have a wife and 2 children, a mortgage for 2 mil. CZK and a consumer loan for 150.000,-CZK.

I choose a death benefit of CZK 600,000 to provide for my family and a decreasing sum assured of CZK 2,150,000 to provide for my liabilities.

Injury

Accident insurance is the simplest part of a life insurance policy. You just need to insure yourself for “daily compensation for treatment of the accident” for the amount corresponding to the loss of income (usually 200 to 500 CZK/day) and for “permanent consequences of the accident”. You should definitely not set your perennials to less than 500 000,-CZK. This amount is paid up to the appropriate percentage of the bodily injury. For the permanent consequences of an accident, insurers offer so-called. Progressions. In practice, this means that in the event of a more serious permanent injury, you could receive up to several times the agreed sum insured.

Disease

This is where I have encountered the most mistakes in my 8 years of practice. Sickness insurance is based on “daily incapacity benefit” and “disability insurance”. It’s also a good idea to take out ‘major illness’ insurance and you can add ‘hospitalisation insurance’.

Daily incapacity benefit

Have you ever been on sick leave? How’d you come out with the paycheck? Now imagine you could be home for a whole year. This is exactly why you should not miss this item in your life. The insurance amount should correspond to the missing part of the monthly income (usually 200 to 500 CZK/day). You should also pay great attention to lockouts, i.e. cases where you do not comply. This is where insurance companies differ greatly.

Disability

Do you have someone in your life who has been treated for cancer? What about intervertebral disc prolapse? You probably know that due to these and other diseases, people have to rearrange their lives considerably. First of all, they are treated for a long time and then (after a year) they are recognised as having some degree of disability. Few are then able to return to their previous job and their income is greatly reduced. Therefore, you should take out disability insurance equal to 1-3 years of your income. Be careful to insure for all 3 levels and again, want the “disability by accident and sickness” option.

How much should I pay?

The cost of life insurance is based on the age, employment, current health and requirements of the client. So there are many variables that play a role. In general, however, an amount of around 5% of your monthly income is adequate.

Should I also insure my wife on parental leave? What about the kids?

If you are alone, your insurance should cover your needs. But when there are more of you, the question arises when to insure the other family members and how. In general, insurance should cover situations that affect your income. For example, a 2-year-old child like that who is being treated for an injury probably won’t affect your income much, because one parent is still at home with them whether they are being treated for something or not. However, in the event that they have to spend some time in hospital, it is already possible that the main breadwinner will also take time off. You should therefore insure your children especially for “serious illness”, “permanent injury” and “hospitalisation”. But you won’t go wrong if you add “daily accident benefit” insurance.

Although a parent on parental leave will receive parental leave regardless of his or her health status, he or she should still be insured at least for more serious events.

Finally…

Does that make your head spin? I’m not surprised. For this reason, most people take the advice of their financial advisor. Unfortunately, anyone can call themselves a financial advisor these days. So if you have arranged for a lifetime at the post office along with sending a letter and you have bought a scratch card to go with it, it is not a bad idea to consult a specialist. The same is true if you have taken out a life insurance policy at a branch of an insurance company or bank. Not that they should give you bad advice, but there is a difference when you are choosing from the products of one insurance company or twenty. I sometimes encounter the opinion that one advisor cannot know the terms and conditions of all insurance companies. The opposite is true. A financial adviser should be able to compare most of the products on the market and only on the basis of such a comparison recommend a specific product to you.

Did you like the article? Let’s have a coffee and discuss what solution would be best for you and possibly modify your existing one.

by Lukas Frank